Vancouver, British Columbia: Whitehorse Gold Corp. (“Whitehorse Gold” or the “Company”) (TSXV: WHG) announces that its common shares have commenced trading on the TSX Venture Exchange (the “TSXV”) under the ticker symbol “WHG” as of market open on November 25, 2020. The Company recently completed its Plan of Arrangement spin-out from New Pacific Metals Corp. and has also closed a $6.79-million non-brokered private placement of common shares. Whitehorse Gold currently has 42,656,700 common shares issued and outstanding.

Whitehorse Gold is a new precious metals exploration and development company focused on its wholly-owned, past producing Skukum Gold Project (formerly named Tagish Lake Gold Project) located in the Whitehorse Mining District of the southern Yukon.

Highlights of Whitehorse Gold and the Skukum Gold Project include:

- Proven management team and Board with strong exploration, development, and operations skills, as well as capital markets experience.

- Current indicated mineral resources of 1,331,000 tonnes containing 274,544 oz gold and 5,355,478 oz silver plus additional inferred mineral resources of 1,111,000 tonnes containing 223,873 oz gold and 1,906,433 oz silver, provide a solid foundation for planned resource expansion initiatives.

- Robust infrastructure (roads, camp, underground development, and a past operating processing complex) allows for year-round access and streamlines potential production path.

- Exploration upside at the three gold deposits (Skukum Creek, Goddell and Mt. Skukum) all remaining open in addition to multiple, underexplored gold zones and occurrences on the project.

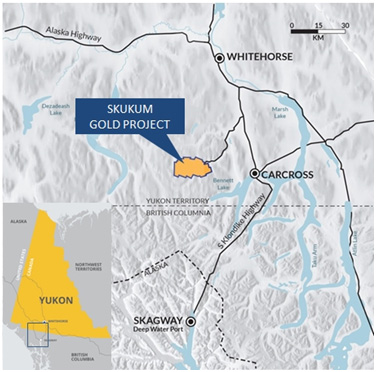

The project consists of 1,051 mineral claims covering an area of approximately 170 square kilometres and is located approximately 55 kilometres south of Whitehorse with direct road access (see Figure 1).

Figure 1: Skukum Gold Project location map

The Company recently completed its 2020 exploration program, which included data compilation, surface mapping and sampling, relogging and sampling of previous drill core and in excess of 2,000 metres of diamond drilling. Assay results from sampling and drill programs will be released as they are received.

“We are excited to secure our TSXV listing as we continue to move forward in unlocking the strong exploration and development potential we envision on the Skukum Gold Project,” stated Kevin Weston, CEO of Whitehorse Gold. “With our inaugural 2020 exploration and drill program now complete, we await assay results as we also develop and plan a more advanced exploration program for 2021. Our goal is to build on the robust, high-grade resource already delineated across the Skukum Gold camp and evaluate environmentally and socially responsible development options over the near term.”

The Skukum Gold Project has excellent infrastructure including all-weather road access from Whitehorse (approximately one-hour drive), an all-weather 50-person camp, approximately 4.8 kilometres of underground workings, an extensive surface road network and a previously operating 300-tpd mill along with a tailings management facility and service buildings. Over 140,000 metres of drilling has been previously completed on the project by former operators from the 1980s to 2011.

Historical underground operations on the Mt. Skukum deposit from 1986 to 1988 saw a total of approximately 233,400 tons of ore mined and processed in the plant, recovering approximately 79,750 ounces of gold under a previous operator.

Whitehorse Gold also announces the completion of an updated independent technical report entitled “Skukum Gold-Silver Project NI 43-101 Technical Report” prepared by Ronald G. Simpson, P.Geo. of GeoSim Services Inc. with an effective date of October 1, 2020, which has been filed on SEDAR and is available on the Company’s website. The independent resource estimate is based on analytical data from 631 drill holes representing 95,056 metres of drilling and 2,925 underground samples.

The Company’s Skukum Gold Project hosts the following global mineral resources:

Skukum Gold Project Global Mineral Resource (using a 3.0 g/t AuEQ cut-off grade):

| Class | Tonnes | Contained oz Au | Contained oz Ag | Contained oz AuEQ |

|---|---|---|---|---|

| Indicated | 1,331,000 | 274,544 | 5,355,478 | 335,611 |

| Inferred | 1,111,000 | 223,873 | 1,906,433 | 245,590 |

The three delineated deposits on the Skukum Gold Project (Skukum Creek, Goddell and Mt. Skukum) individually host the following mineral resources:

Skukum Creek Deposit Mineral Resource (using a 3.0 g/t AuEQ cut-off grade):

| Class | Tonnes | Au (g/t) | Ag (g/t) | AuEQ (g/t) | Contained oz Au | Contained oz Ag | Contained oz AuEQ |

|---|---|---|---|---|---|---|---|

| Indicated | 1,001,300 | 5.85 | 166.4 | 7.75 | 188,334 | 5,355,478 | 249,401 |

| Inferred | 537,000 | 4.99 | 108.3 | 6.22 | 86,124 | 1,869,065 | 107,415 |

Goddell Deposit Mineral Resource (using a 3.0 g/t Au cut-off grade):

| Class | Tonnes | Au (g/t) | Ag (g/t) | AuEQ (g/t) | Contained oz Au | Contained oz Ag | Contained oz AuEQ |

|---|---|---|---|---|---|---|---|

| Indicated | 329,700 | 8.13 | - | 8.13 | 86,210 | - | 86,210 |

| Inferred | 483,900 | 7.13 | - | 7.13 | 110,867 | - | 110,867 |

Mt. Skukum Deposit Mineral Resource (using a 3.0 g/t AuEQ cut-off grade):

| Class | Tonnes | Au (g/t) | Ag (g/t) | AuEQ (g/t) | Contained oz Au | Contained oz Ag | Contained oz AuEQ |

|---|---|---|---|---|---|---|---|

| Inferred | 90,100 | 9.28 | 12.9 | 9.43 | 26,882 | 37,368 | 27,308 |

Cost Assumptions used in Cut-off Grade Determination:

| Assumptions | Value |

|---|---|

| Gold Price (US$ per oz) | $1,450 |

| Silver Price (US$ per oz) | $16.50 |

| Gold Recovery | 90% |

| Silver Recovery | 90% |

| Underground Mining Cost (US$ per tonne milled) | $90 |

| Processing (US$ per tonne milled) | $25 |

| G&A Cost (US$ per tonne milled) | $10 |

| Total Operating Cost (US$ per tonne milled) | $125 |

| Cut-off Grade (g/t Au) | 3.0 |

Notes:

- CIM Definition standards (2014) were used for reporting the Mineral Resources.

- Mineral resource estimate prepared by GeoSim Services Inc. with an effective date of October 1, 2020.

- Mineral Resources are not mineral reserves and do not have demonstrated economic viability. An Inferred Mineral Resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- A base case cut-off grade of 3.0 g/t Au represents an in-situ metal value of US$126 per tonne at a gold price of $1450/oz, silver price of $16.50/oz and a metal recovery of 90% for gold and silver, which is believed to provide a reasonable margin over operating and sustaining costs for narrow vein mining and processing.

- Mineral resources are diluted to a minimum width of 1.5 metre.

- Technical report filed on SEDAR on November 18, 2020.

- Totals may not sum due to rounding.

Qualified Persons

The independent Qualified Person for the mineral resource estimate is Ronald G. Simpson, P.Geo. from GeoSim Services, Inc. The technical information contained in this news release has been reviewed and approved by Tim Kingsley, Vice President of Exploration of Whitehorse Gold and a Qualified Person for the purposes of National Instrument 43-101 – Standards of Disclosure of Mineral Projects (“NI 43-101”).

On Behalf of Whitehorse Gold Corp.

“Kevin Weston”

CEO & Director

For further information please contact:

Steve Stakiw, Vice President - Corporate Affairs

Phone: 1-604-336-5919

Email: info@whitehorsegold.ca

www.whitehorsegold.ca

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933 (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons (as defined in the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration is available.

ABOUT WHITEHORSE GOLD CORP.

Whitehorse Gold is focused on its wholly owned Skukum Gold Project (formerly named Tagish Lake Gold Project) located in the Whitehorse Mining District of the southern Yukon. The project consists of 1,051 mineral claims covering an area of 170 square kilometres and is located approximately 55 kilometres south of Whitehorse, Yukon, in the Wheaton River Valley region. The project hosts the advanced-stage Skukum Creek, Goddell and Mount Skukum high-grade gold deposits and multiple high-priority exploration targets. Project infrastructure includes an all-weather access road, an all-weather 50-person camp, approximately 4.8 kilometres of underground workings, an extensive surface road network and a previously operating 300-tpd mill along with a tailings management facility and service buildings. Over 140,000 metres of drilling have been previously completed on the project by former operators. Historical underground operations on the Mount Skukum deposit from 1986 to 1988 saw a total of 233,400 tons of ore mined and processed in the plant, recovering approximately 79,750 ounces of gold under a previous operator.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collective, “forward looking statements”) within the meaning of applicable Canadian and U.S. securities legislation. All statements, other than statements of historical fact included in this release, including, without limitation, statements regarding the expected commencement of trading of the Company’s common shares on the TSXV, future plans with respect to the Skukum Gold Project and other future plans of Company, and objectives or expectations of the Company are forward-looking statements. Estimates of mineral reserves and mineral resources are also forward-looking information because they incorporate estimates of future developments including future mineral prices, costs and expenses and the amount of minerals that will be encountered if a property is developed. Forward-looking statements are often, but not always, identified by words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions. Forward-looking statements are based on the opinions, assumptions, factors and estimates of management considered reasonable at the date the statements are made. The opinions, assumptions, factors and estimates which may prove to be incorrect, include, but are not limited to: that market fundamentals will result in sustained precious metals demand and prices; that there are no significant disruptions affecting operations, including labour disruptions, supply disruptions, power disruptions, security disruptions, damage to or loss of equipment, whether due to flooding, political changes, title issues, intervention by local landowners, environmental concerns, pandemics (including COVID-19) or otherwise; that the Company will be able to obtain and maintain governmental approvals, permits and licenses in connection with its current and planned operations, development and exploration activities, including at the Skukum Gold Project; that the Company will be able to meet its current and future obligations; that the Company will be able to comply with environmental, health and safety laws; and the assumptions underlying mineral resource estimates and the realization of such estimates.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others: social and economic impacts of COVID-19; actual exploration results; changes in project parameters as plans continue to be refined; results of future resource estimates; future metal prices; availability of capital and financing on acceptable terms; general economic, market or business conditions; uninsured risks; regulatory changes; defects in title; availability of personnel, materials and equipment on a timely basis; accidents or equipment breakdowns; delays in receiving government approvals; unanticipated environmental impacts on operations and costs to remedy same; and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this news release or incorporated by reference herein, except as otherwise required by law.

Cautionary Note to US Investors

This news release has been prepared in accordance with the requirements of NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards, which differ from the requirements of U.S. Securities laws. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.